Under this proposal, an eligible S corporation must liquidate and transfer substantially all its assets to an entity taxed as a domestic partnership during a two-year period beginning on December 31, 2021.

To be eligible, a corporation must have been an S corporation on May 13, 1996, before the current “check the box” regulations were published. The Ways and Means Committee has proposed a rule that would temporarily allow eligible S corporations to reorganize as partnerships without triggering tax. Temporary Rule to Allow Certain S Corporations to Reorganize as Partnerships without Tax These changes would apply to taxable years beginning after December 31, 2021. Finally, the proposal would also extend regulatory authority to address arrangements that avoid the purposes of Section 1061. Additionally, the proposal would modify rules on sale or exchange transactions. This presumably would include partnership interests in all kinds of businesses, rather than just businesses affected by current Section 1061-those involved in raising or returning capital or investing in securities, commodities, rental real estate, and options and derivatives. Second, the proposal would extend Section 1061 to all assets eligible for long-term capital gains rates.

The proposal would add rules for measuring these three and five year holding periods. The three year holding period would apparently still be allowed for certain real property trades or businesses and taxpayers with adjusted gross income less than $400,000. In effect, the goal of Section 1061 is to limit the availability of long-term capital gains for these equity incentives upon sale.įirst, this proposal would provide long-term capital gain treatment only to applicable partnership interests held longer than 5 years (up from 3 years). The proposal would significantly amend Section 1061 of the Internal Revenue Code, which governs the character of gain on the sale of an applicable partnership interest granted to a service provide. “Carried interests” or “profits interests,” while long a preferred equity incentive for partners in partnerships and LLCs, have been viewed by many in Congress with skepticism. Modification of “Profits Interests” and “Carried Interest” Rules

Personal services corporations would be ineligible for these rates.īenefits of the lower end of the graduated rates would phase out for corporations with income in excess of $10 million. The rate would decrease to 18 percent for corporations with income less than $400,000. Corporations with net income up to $5 million would be taxed at 21 percent. The top rate would increase to 26.5 percent for corporations with net incomes exceeding $5 million. The Ways and Means Committee has proposed replacing the flat corporate income tax with a progressive rate structure. Increases (and Decreases) in Corporate Tax Rate A few of the major changes are summarized below:

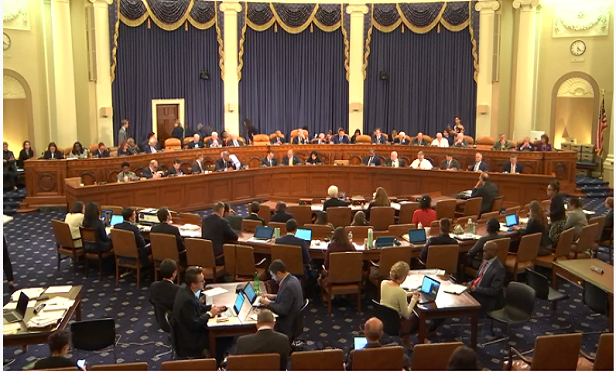

HOUSE WAYS AND MEANS COMMITTEE SERIES

Included in the proposed legislation are a series of domestic tax modifications for businesses. Accordingly, this article should be used as a view to what tax changes may be coming on the horizon legislatively. Note: the Ways & Means Committee’s proposals are still being crafted and finalized, and these proposals still need to be crafted into legislation. The proposed changes would help to pay for the social and economic policies advanced in the $3.5 trillion budget reconciliation package Congress has been working on, which the Democrats and President Biden hope to pass this fall. Ways and Means Committee released draft legislation advancing a number of tax increases and changes.

0 kommentar(er)

0 kommentar(er)